Anguilla Hotel and Villas For Sale

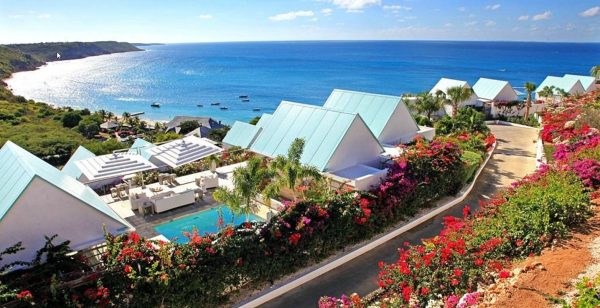

Century21 St Maarten presents to you CeBlue Anguilla Hotel; a collection of beach villas with land to develop luxury condos near the beach.

CeBlue Luxury Resort & Condo Development

The subject property is currently a villa resort comprising 8 buildings with 5 villas per building or 40 keys. The property is currently managed locally with minimum stay restrictions of 4 nights during the shoulder and low season and 7 nights during the high season.

The owners of the property wish to explore the possibility of expansion of the resort and changing the formula of operation to a full-service luxury hotel facility operated by an international management company. An Anguilla hotel, consisting of 30 two-bedroom units and 15 three-bedroom units, would provide 105 keys of hotel inventory (45 suites and 60 rooms) when designed with lock-off en-suite bedroom units. Financials, construction cost, and more towards the end of this page.

Only 17 miles long and three miles wide, Anguilla is 10 miles north of St. Maarten and 200 miles east of Puerto Rico. The subject property is located on the north coast of the island on Crocus Bay.

A broad SWOT analysis of is shown below. This is not necessarily exhaustive but provides a framework for consideration.

Strengths

- A number of world class hotels

- Excellent restaurants & Cuisine

- Upmarket appeal

- Exceptional beaches & pristine environment

Opportunities

- Physical space of expansion

- Commitment to tourism development by government

- Implementation of classification / standard system

CeBlue Anguilla Villas

Each villa contains nearly 8,000 square feet of luxury living space, combining traditional outdoor living with modern luxury, including vaulted ceilings with teak wood and beams.

CéBlue combines the security of a community with the privacy of an individual villa. Each villa has a stunning view of the turquoise waters of the sea, and the landscaping is a site to enjoy in itself with all the Caribbean colors.

Each villa has a flexible configuration allowing guests to reserve just the right size from one to six bedrooms. Each bedroom offers its own elegant bathroom. Privacy abounds for you, your family and your friends! Click here to view the floor plans of CéBlue Villas.Each villa boasts its own private salt water swimming pool along with an outdoor shower and water feature poolside. Two decks, one open to the sky and the lower deck shaded from the sun, both offering spectacular views.

The kitchens have custom made cupboards, top-of-the-line stainless steel appliances which include a gas cooking, a wine cooler and everything you would want in a gourmet kitchen. They are appointed with beautiful countertops, glass tile back-splashes, Brazillian Quartize flooring and so much more.

Exterior:

- Private Salt Water Swimming Pool with Sun Deck

- Outdoor Bathroom with Shower

- Lighted Water Feature Next to Pool

- Outdoor Speakers

- Stainless Steel Umbrella

- Stainless Steel BBQ Grill

- Two Parking Spaces

- Tiled Wooden Deck that Extends Out for Views of Crocus Bay

- Comfortable Outdoor Furnishings and Outdoor Dining

Resort Facilities:

- Concierge

- Fitness Center

- Children’s Game Room

- Table Tennis Room

- Bar with Wood-Burning Pizza Oven

- Blue Bar Sunset Lounge

- Men and Women Restrooms

- Commercial Laundry Room

- Commercial Kitchen

- 24-Hour Caretaker Apartment

- Nearby Oceanfront Restaurant and Spa

- Non-Motorized Water Sports and Beach Attendants

Kitchen and Dining Room:

- Stainless Steel Refrigerator, Oven, Microwave and Dishwasher

- Cuisinart Coffee Maker, Toaster, Juicer, Blender and Hand Mixer

- Dining Table for 12

- Glass Doors that Fully Open

- Wine Cooler

- Individual Air Conditioning System

- Dinnerware, Silverware, Glassware and Cookware

- Kitchen Accessories and Tools

Media Room:

- 55′ Flat Screen TV

- DVD Player

- Xbox/Kinect Game Console

- Italian Leather Sofa, Two Chairs and Sofa Sleeper

- Office Desk with Chair

Bedrooms:

- Italian Custom-Made Bedroom Set

- Two Night Stands

- Armoire

- Makeup Desk and Chair

- Fully-Equipped Closet

- Full Body Mirror

- Mesa Keypad Safe

- Small Fridge

Bathrooms and Accessories:

- Spacious Bathrooms with Separate Toilet Area

- Dual Sinks

- Spacious Walk-In Shower

- Kohler Ceiling Rainmaker

- Separate Claw-Foot Bathtub with View of Crocus Bay

- Individual Air Conditioning System

Environmental Features:

- LED Lighting Fixtures Throughout

- Environmentally Friendly Construction Materials

- Banana Trees and Other Fruit Trees

- Anguilla Natural Stone for Landscaping Rock Walls and Countertops

Safety and Security:

- Night Security

- Hurricane Rated Construction and Windows

- Backup Generator

- Reverse Osmosis Water Plant & Backup Public Water

- 2 Comoglass Sewage Tanks

Anguilla Comparative Hotel Analysis

CAP JALUCA ANGUILLA

LOCATION: MAUNDYS BAY ANGUILLA

BUILT / LAST RENOVATED: 1992 renovated 2005

NO OF ROOMS: 70

ROOM RATES US$495 ‐ $1485

HTI RATING 9 ‐ Deluxe

Descritption

Situated on the southwest coast of Anguilla and overlooking the mountains of St. Maarten only seven miles away, Cap Juluca is perched on 179 acres of land and inland waters. The resort offers privacy and exclusivity located on 2 miles of white sand beach. Anguilla is only 25 minutes by boat from the shops, restaurants, gambling, and international flavours of Dutch and French St. Maarten, and 15 minutes by air or 45 minutes by boat to St. Barths. The accommodations comprise eighteen separate Moorish-style beachfront villas each with no more than 6 rooms or suites. There are six private pool villas that can be enjoyed as either a one-bedroom suite or have up to 5 bedrooms. All rooms are spacious, each with an ocean view and direct beach access. All villas are a short, white sand beach walk from the award-winning restaurants.

FEASABILITY STUDY FOR CEBLUE CONDOS

The Development Site and its Location

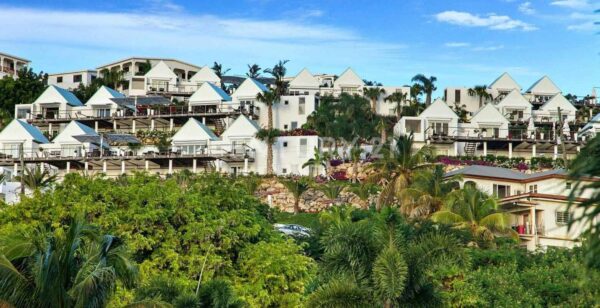

The land on which the existing CéBlue villas and the expansion site is located offers, arguably, the best view in Anguilla. The immediate view is along Crocus Bay beach with no development on the low-lying land behind the beach. The long view is along the whole north coast of Anguilla with islands and reefs out to sea. The drive time from the airport (10 minutes) is the shortest of any major resort on the island, although there is no aircraft noise at the site, and the ferry port is only 20 minutes away. Crocus Bay is a favorite spot for superyachts to anchor in a sheltered location.

The beach already has a well-constructed dock for smaller vessels – suitable for dive boats and day trip boats – and the Davida bar/restaurant complex is located in the middle of the beach. The developer’s intention is to lease this property, with the advantage that only further resort accommodations need be added for the successful expansion of the existing CéBlue Resort. CéBlue already has a reception area, spa and a casual dining/bar facility.

Planning

Planning permission for this low-density development scheme is in line with the site’s designated use for tourism development and the project has received strong support from Government so no problems are envisaged for detail planning approval of the larger resort now envisaged. The development’s designs will meet current guidelines and codes for Anguilla and meet environmental impact assessment requirements. The resort’s policies on sustainability will ensure compliance with the latest standards for resorts in that regard.

The Proposed Product

Designed as a tightly focused ‘condominium hotel’ product, the CéBlue expansion will be the first of this exact type to be offered in Anguilla and will represent a value for money real estate investment for buyers who seek good rental income in addition to enjoying their vacation home. CéBlue’s expansion will feature 45 condos of two and three bedrooms. The 15 three-bedroom penthouses and 30 two-bedroom condos are designed on a modular basis to create an ultra-flexible condo-hotel design for a resort.

The standardized 600 square feet module is 40 feet x 15 feet, 450 square feet internal with 150 square feet part covered/part open terrace. Thus, two and three-bedroom condos are of 1,800 and 2,400 square feet. The design also allows the 2,400 square feet penthouses to be augmented with two rooftop outdoor terrace areas.

With interconnecting doors, multiple options for hotel inventory are created – lock-off en-suite bedrooms and one/two/three-bedroom suites. Maximum total hotel keys are 105, where the 15 penthouse units plus 30 two-bedroom condos are rented as 45 one-bedroom suites plus 60 lock-off ensuite bedrooms.

5 Star Amenities

Development of 3,000 square feet of meeting space and staff areas will add to the comprehensive resort leisure facilities and support areas. Resort amenities include guest concierge and reception, three restaurants/bars, spa facilities, a swimming pool and access to the dock below for dive boats, day catamaran sails, etc.

Ask for the complete Feasibility Study conducted in 2017.

Call Ritika on +1721-550-0555

FINANCE CALCULATOR

Accurately providing a finance calculaton for your mortgage, owner or partial finance calculation.

Yes we can help you get a bank finance deal!

Contact us for a quicker decision from the banks!

Transfer Tax |

4% |

Property Tax |

0% |

Capital Gains Tax |

0% |

$

$

%

Ritika Asrani will call you as soon as possible

No obligation phone call. Think of me as a friend in paradise!

Urgent Enquiry?